Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- Increased sales & stable prices fuel property market boost.

- Construction sector emerges from six-month decline.

- Inflation falls to lowest level in two and-a-half years.

- Rate Reducer scheme offers sub-1% rates for new build buyers.

- UK economic barriers to subside & set the scene for accelerated growth.

Key takeaway 1: Increased sales & stable prices fuel property market boost

The UK property market continues to show steady signs of improvement, with the main headline for RICS’ UK Residential Market Survey for March focusing on increasing sales volumes generated by a modest rise in enquiries and listings.

RICS reports that the number of survey participants anticipating a rise in sales volumes over the next three months has more than doubled to +13% compared to +6% in the previous month’s Market Survey. From a 12-month perspective, +46% of participants envisage sales activity rising (up from +42%).

New buyer enquiries continue to increase at a ‘gentle pace,’ putting buyer demand in more of a positive position overall - an aggregate net balance of +8% of respondents reported an increase in new buyer enquiries in March (the third consecutive month the measure has been above zero). Interestingly, Savills has observed an increased commitment among prospective buyers to move. It also says buyers’ budgets are beginning to edge upwards, particularly among ‘upsizers.’

As for new listings, they have risen for the fourth successive report, which is highlighted by +13% of survey respondents reporting an uplift in new instructions during the month.

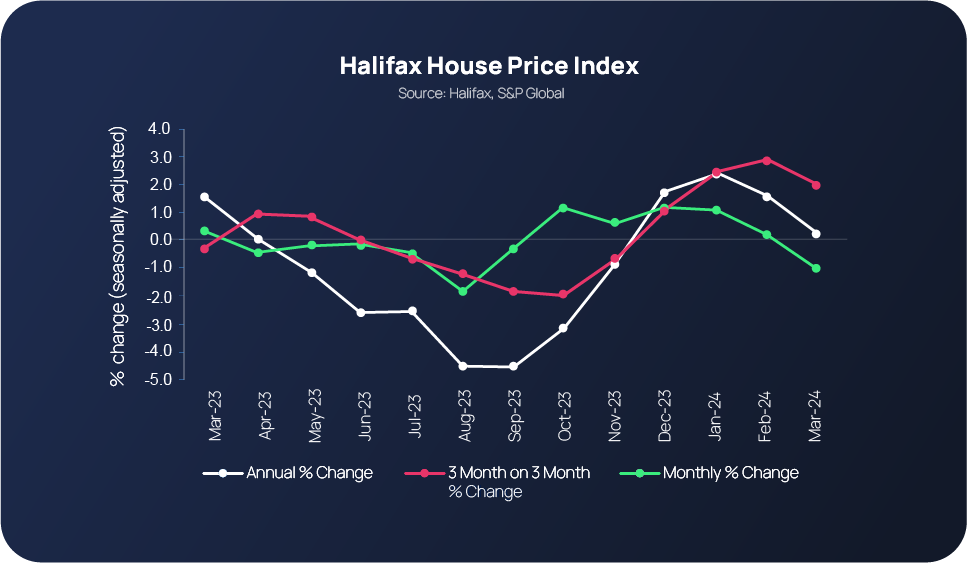

Meanwhile, house prices have stabilised at the headline level as a result of all regions/countries reporting less negative and more positive readings. According to Halifax’s House Price Index for March, the average house price is £288,430, which represents a -1% monthly, +2% quarterly and +0.3% annual change. Halifax notes that ‘house prices have shown surprising resilience in the face of significantly higher borrowing costs.’

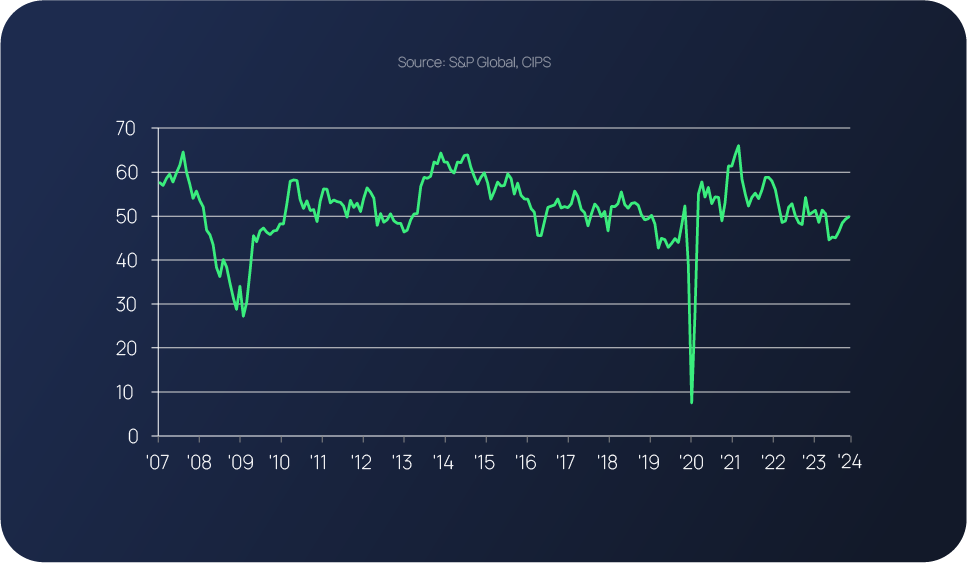

Key takeaway 2: Construction sector emerges from six-month decline

The sector saw its' strongest increase in new orders since May last year’ and reported a fractional rise in overall sector-wide outputs. These results finally put an end to construction’s six-month period of decline, with survey respondents experiencing a turnaround in sales pipelines and more new business enquiries. This upturn has been linked to the improving economic outlook and more stable financial conditions.

New order volumes expanded at the fastest pace since May 2023. Meanwhile, civil engineering stood out as the best-performing segment due to a marginal increase in output levels, which were attributed to infrastructure projects and resilient energy sector demand. As for housebuilding and commercial construction, activity remained unchanged, resulting in residential activity levels stabilising for the first time since November 2022.

CrowdProperty’s own lead indicator of developer activity – applications for development finance – showed record ever levels of both value and volume of applications in March, for projects worth over £750m. March’s record has been further surpassed in April – SME developers are seeing opportunity in this market.

Key takeaway 3: Inflation falls to lowest level in two and-a-half years

UK inflation slowed by slightly less than anticipated in March, leading to further widespread speculation that the first interest rate cut from the Bank of England could take longer to transpire.

The latest set of ONS figures showed that consumer prices rose by an annual 3.2% (down from a 3.4% increase in February), putting them at their lowest level for the last 2.5 years. An uplift in annual inflation in the US (3.5% in March vs 3.2% in February) has been highlighted as one of the contributing factors for an anticipated slow down. As a result, UK inflation is now below US inflation levels for the first time since early 2022, although swap rates – the rate at which banks and building societies lend to each other - have risen, with HSBC, Barclays, NatWest, Leeds Building Society and Accord increasing selected fixed mortgage rates.

Economists anticipate the UK annual inflation rate will return to the Bank of England’s 2% target later this spring (given high monthly rates recorded in spring 2023 still included in the annual figures), triggering an interest rate cut post-June. According to Deloitte’s chief economist, Ian Stewart, wage-related pressures remain a key challenge for the Bank of England: “Inflation is in retreat, but the Bank of England cannot yet be sure that it is beaten. Headline inflation is likely to drop below 2.0% in the coming months, but to be confident it will stay there, wage pressures need to ease. With earnings growing at close to 6.0%, and the economy reviving, the Bank will be in no hurry to cut interest rates.”

Key takeaway 4: Rate Reducer scheme offers sub-1% rates for new build buyers

Rate Reducer is a new mortgage product that has been developed by finance company, Own New, to help people purchase new build properties at a lower mortgage rate (as low as 0.99% in some circumstances).

Both first-time buyer and existing homeowners are eligible to benefit from the scheme, which was launched in conjunction with Barratt Developments, and is currently available via Halifax and Virgin Money.

Historically, homebuilders have always provided customers with some form of incentive to buy, ranging from covering Stamp Duty costs to contributing towards their deposit. Under the Rate Reducer scheme, these incentives are used to reduce the buyer’s rate on their mortgage, making their monthly payments more affordable.

Persimmon, Taylor Wimpey, Bellway and Berkeley Homes, as well as lenders, Gen H, Furness Building Society and Perenna, are all reported to also be getting involved with the initiative.

Key takeaway 5: UK economic barriers to subside & set the scene for accelerated growth

The EY ITEM Club Spring Forecast leads with the prospect that ‘stagnation nation may be in the past’ due to all of the key markers for growth this year being in place and the economic shocks from the last few years finally subsiding. Rising wages and consumer spending, falling energy bills and inflation and the prospect of an interest rate cut at some point this year are all key contributors towards the Club’s current economic predictions, which includes the UK economy growing by 0.7% this year.

Just as the property market has reported a ‘modest’ rise in enquiries and listings, the UK’s economic outlook for the rest of this year is anticipated to follow the same trajectory, with projected GDP growth being slightly upgraded from 1.8 to 2%.

According to Hywel Ball, EY UK Chair, 2024’s forecast may be subdued, but it marks an important turning point for the UK economy: “High inflation, energy prices and interest rates have mired the UK in economic stagnation in recent years, but all three obstacles to growth have now either fallen away already or are expected to diminish in 2024.

“Business investment is predicted to see modest growth this year before accelerating in 2025. Rising business confidence and spending, alongside improved economic conditions, should set the stage for a welcome return to growth in the near future.”

Mike Bristow, CEO of CrowdProperty comments:

“There are further positive signs for the property market this month with indications of increased demand, another uplift in instructions and listings and continued resilience in house prices. This upward trend – albeit modest – is set against the encouraging backdrop of falling inflation and a marginally improved economic outlook.

“As a company we’re seeing a strong uptick in interest for ground up property development finance. The Rate Reducer scheme for buyers of new builds could provide further reason for property developers to consider ground-up projects, as could the emerging housebuilding election battleground. We’re already seeing many line up their finance provider ready to leap on the purchase of the right site.”

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £840m worth of property projects to date

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply – our passionate team of property experts will share their insights and initial funding terms for your project within 24 hours, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...